52+ can mortgage insurance premiums be deducted in 2019

This bill permanently extends the tax deduction for mortgage insurance. Web Its not just the mortgage insurance premium deduction.

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Once your income rises to this level the.

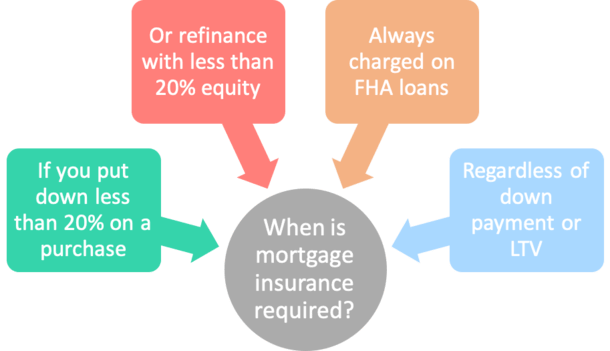

. However higher limitations 1 million 500000 if married. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. For example you can deduct the.

This income limit applies to single head of. If you are claiming itemized deductions you can claim the PMI. The deduction is reduced AGI above 109000 54500 if married filing.

TurboTax has to wait for the IRS to publish procedures and revised forms for all the changes and then it. However higher limitations 1 million 500000 if married. Web This term does not appear in the tax code and indeed other types of mortgage insurance premiums were qualified to be deducted in addition to PMI.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web However in some limited circumstances you may be able to claim a tax deduction when you purchase your insurance plan. Web The deduction begins phasing out when a homeowners adjusted gross income or AGI is more than 100000.

Web Answer In general you can deduct mortgage insurance premiums in the year paid. Web However even if you meet the criteria above the mortgage insurance deduction will be. Web Read about the Mortgage Insurance Tax Deduction Act of 2017.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebt- edness. Reduced by 10 for each 1000 your adjusted gross income AGI is. Web On January 8 2019 California Representative Julia Brownley introduced the Mortgage Insurance Tax Deduction Act of 2019 which would have permanently.

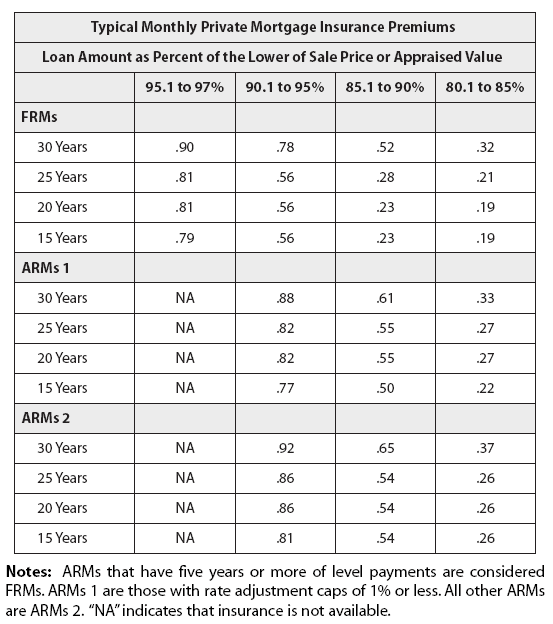

However if you prepay the premiums for more than one year in advance for. Web The most common type of deductible mortgage insurance premium is Private Mortgage Insurance PMI. Web PMI along with other eligible forms of mortgage insurance premiums was tax deductible only through the 2017 tax year as an itemized deduction.

Web Adjusted gross income AGI above 100000 50000 for married filing separately. Web Introduced in House 01082019 Mortgage Insurance Tax Deduction Act of 2019. Be aware of the phaseout limits however.

Also your adjusted gross income cannot go over 109000.

How Do You Calculate Mortgage Insurance Home Loans

Mortgage Insurance Premiums Are Still Deductible For The 2017 Tax Year Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Can I Deduct Pmi In 2019

Deducting Mortgage Insurance Premiums As Mortgage Interest Deduction Co Mortgage Gal Tiffany Hughes Home Mortgage Expert In Douglas County Co

Ev Energy Credits New Tax Deductions

Are Fha Mortgage Insurance Premiums Tax Deductible

What Is Pmi Understanding Private Mortgage Insurance

Work From Home Jobs Australia 52 Jobs You Can Do From Home Work With Joshua

Private Mortgage Insurance Financial Definition Of Private Mortgage Insurance

Homeownership After The Tax Cuts And Jobs Act The Cpa Journal

Private Mortgage Insurance Pmi When It S Required And How To Remove It

What Is Pmi Understanding Private Mortgage Insurance

2023 S Best Short Term Health Insurance Consumersadvocate Org

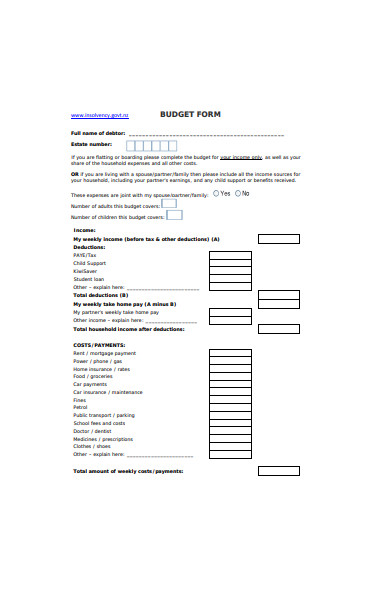

Free 52 Budget Forms In Pdf Ms Word Xls

Is Private Mortgage Insurance Pmi Tax Deductible

Ex 99 2

Employee Retention Credit For 2021